Putting The Real Estate Investment Trust Under The Microscope: What Do Savvy Investors See?

The real estate investment trust (REIT) gets marketed as the easy way into property investing. Instant diversification. Professional management. Stock market liquidity. No tenant headaches or maintenance calls.

Sounds perfect, right? Except that there’s a complex truth REIT salespeople don’t want you to know about.

As real estate developers who work with international investors evaluating different investment structures, we see what happens when people discover too late that a real estate investment trust operates very differently from actual property ownership. The marketing materials emphasize convenience while glossing over fundamental limitations that can seriously impact your returns and control.

In this article, we’ll review what REIT salespeople typically won’t tell you upfront about the real estate investment trust structure and its impact on your investment capital.

Understanding What a Real Estate Investment Trust Actually Is

A real estate investment trust pools money from multiple investors to buy and manage property portfolios. You purchase shares in the trust, which owns apartment buildings, office complexes, shopping centers, or other commercial real estate. The REIT collects rent, pays expenses, and distributes remaining income to shareholders as dividends.

In today’s day and age, there’s even blockchain investment platforms which sounds even more appealing, until you take into account those specific risks (but that’s a story for another time).

Conventional REITs seem straightforward. Instead of buying a $2 million property yourself, you can invest $10,000 in a real estate investment trust that owns hundreds of properties. You get exposure to real estate without property management responsibilities, and you can sell your shares whenever you want.

At least, that’s how it’s supposed to work.

But between the marketing pitch and actual performance, several critical issues emerge that fundamentally change whether a real estate investment trust makes sense for serious investors.

Risk #1: You Never Actually Own Anything Tangible

The biggest misconception about investing in a real estate investment trust is that you’re buying real estate. You’re not. You’re buying shares in a company that owns real estate.

When you invest in direct property ownership, you control a tangible asset. You can visit it, renovate it, refinance it, or sell it on your timeline. If the property appreciates, you capture that value directly.

With a real estate investment trust, you own paper that represents a fractional claim on properties you’ll never see, in markets you didn’t choose, managed by people you didn’t hire. When the Trust eventually liquidates or restructures, you don’t receive property, you receive whatever cash value remains after management takes their cut.

This distinction matters enormously during market stress. Direct property ownership in Miami gives you options: hold through downturns, refinance to improve cash flow, make strategic improvements, or wait for better selling conditions. A real estate investment trust gives you one option: watch the share price and hope management makes good decisions.

For international investors particularly, the psychological difference between owning actual Miami property versus owning shares in a trust that owns properties somewhere proves significant over time.

Risk #2: REITs Trade Like Stocks, Not Real Estate

Here’s the irony: investors choose a real estate investment trust to get real estate exposure, but the investment behaves like a stock.

Real estate traditionally provides stability because property values don’t fluctuate minute-by-minute based on market sentiment. A luxury home in Coral Gables doesn’t suddenly drop 20% in value because the stock market had a bad week.

But publicly traded real estate investment trusts absolutely do. During the 2008 financial crisis, many REITs saw a max negative return of up to 75%! The real estate itself was fine. The share prices collapsed because they traded on stock exchanges subject to panic selling.

This defeats the entire purpose of real estate investment in Miami or anywhere else. You’re supposed to be diversifying away from stock market volatility, not replicating it with a real estate wrapper.

Non-traded REITs avoid this problem by not trading on exchanges, but they create different issues we’ll address shortly. The point remains: a real estate investment trust doesn’t provide the stability that direct property ownership delivers.

When markets get volatile, direct real estate investment in Miami through development partnerships maintains value based on actual property fundamentals, not daily trader sentiment.

Risk #3: Zero Control Over Management Decisions

With direct property ownership, you make the decisions. Should you renovate? Decide to rent your property and accept a tenant? Sell now or wait? You control the strategy.

A real estate investment trust makes all these decisions for you and you have essentially no input.Management decides which properties to buy, when to sell, how much debt to take on, which markets to enter or exit, and how to allocate capital across the portfolio. If they make poor choices, your investment suffers. If they pay themselves excessive fees, your returns shrink. If they pursue growth strategies that increase risk, you’re along for the ride whether you like it or not.

This becomes particularly frustrating when you disagree with management’s direction but can’t do anything except sell your shares at whatever the current market price happens to be.

Direct real estate investment in Miami through partnerships like AGD gives you a fundamentally different relationship. You choose the specific project, understand the timeline, know the exit strategy, and partner with a team whose interests align with yours from day one.

Risk #4: Management Fees Continuously Eat Your Returns

Every real estate investment trust charges management fees: asset management fees, property management fees, acquisition fees, disposition fees, and financing fees to name a few. The fee structures can be byzantine.

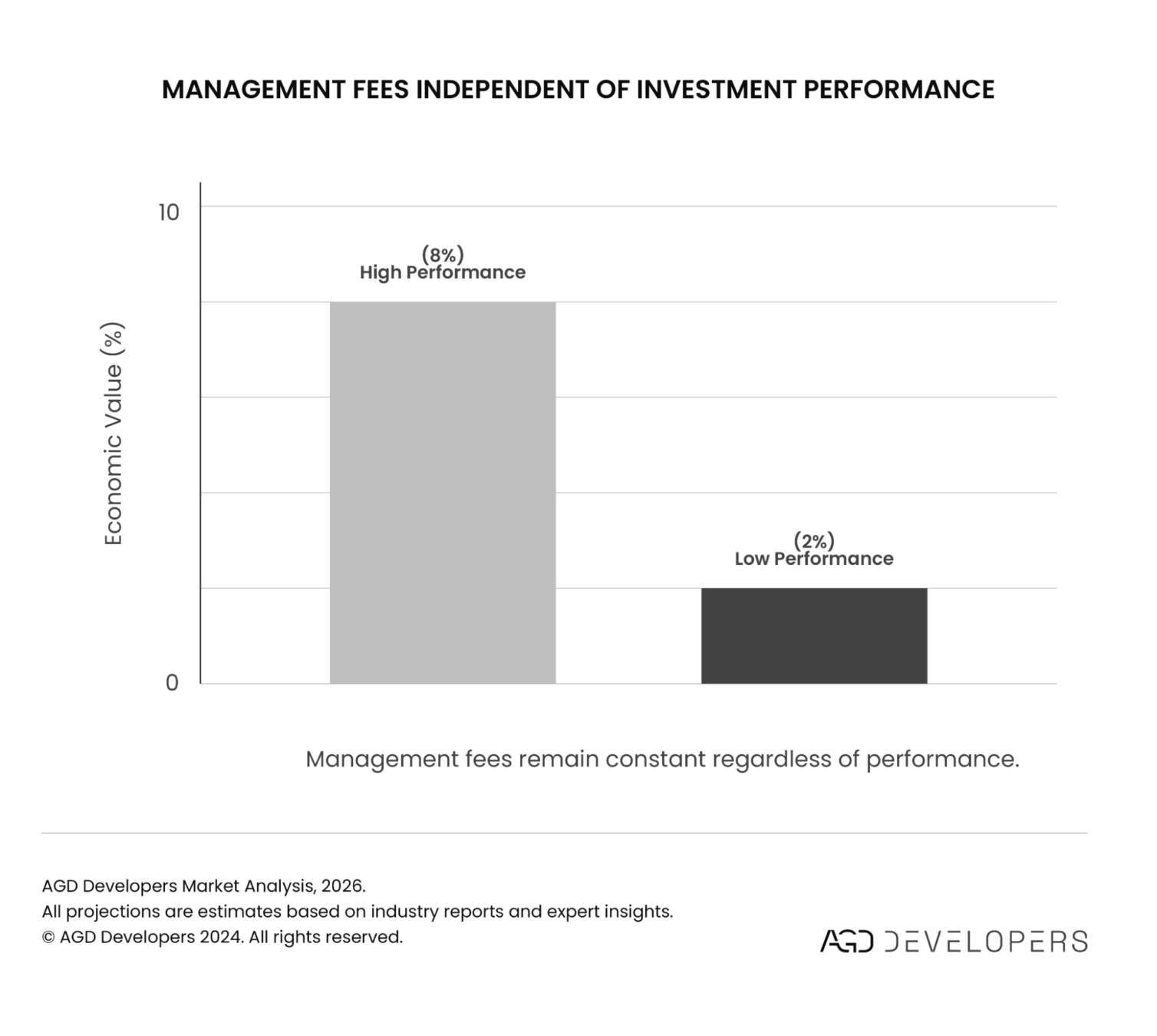

Here’s what makes this particularly problematic: managers get paid regardless of performance. Whether the real estate investment trust delivers 8% returns or 2% returns, management collects their fees. They’re incentivized to grow assets under management (which increases their fees) rather than necessarily maximize investor returns.

Compare this to direct property ownership where you pay specific costs for specific services.

With a real estate investment trust, fees are embedded in the structure. A REIT might advertise 6% dividend yields, but after accounting for all management fees, the actual return to investors might be considerably lower and you can’t easily separate out what you’re paying for what.

For investors focused on real estate investment in Miami specifically, working directly with developers means transparent cost structures where every expense is visible and justified.

Risk #5: Liquidity Isn’t Always Liquid

One major selling point of a real estate investment trust is liquidity. Unlike owning property that might take months to sell, REIT shares supposedly trade instantly on stock exchanges.

In theory, yes. In practice, it depends.

Publicly traded REITs do offer daily liquidity under normal conditions. But during market stress (exactly when you might want to sell) bid-ask spreads widen, prices crater, and selling can mean accepting significant losses even if underlying properties remain valuable.

Non-traded real estate investment trusts present even bigger liquidity challenges. These vehicles often lock up capital for 5-7 years or longer. If you need money before then, you might not be able to access it at all. And when redemption windows do open, there’s typically far more demand to sell than the REIT can accommodate, meaning you’re stuck anyway.

This creates a peculiar situation where you have less liquidity than if you’d just bought property directly. At least with a Miami residence, you can list it for sale tomorrow. With many real estate investment trust structures, you’re genuinely trapped until management decides to allow redemptions.

Direct real estate investment in Miami through development partnerships typically has clear timelines and exit strategies. You know from the beginning when the project completes, when properties sell, and when you receive returns. There’s no pretense of daily liquidity, but there’s also no surprise that you can’t access capital when you need it.

Making Informed Decisions About Real Estate Investment Trust Alternatives

Understanding real estate investment trust risks doesn’t mean avoiding real estate entirely. It means recognizing that property investment works best when you have actual ownership, transparent costs, and aligned interests with your partners.

AGD’s development partnership model provides what a real estate investment trust can’t: direct ownership in specific Miami luxury properties with clear timelines, transparent cost structures, and professional management that works for you rather than charging fees regardless of performance.

When you partner on a Miami development project, you’re not buying shares in a faceless portfolio. You’re co-owning a specific property in Pinecrest, Coral Gables, or Coconut Grove. You can visit the site. You understand the target buyer. You know the sales timeline. You see exactly where capital goes and what returns to expect.